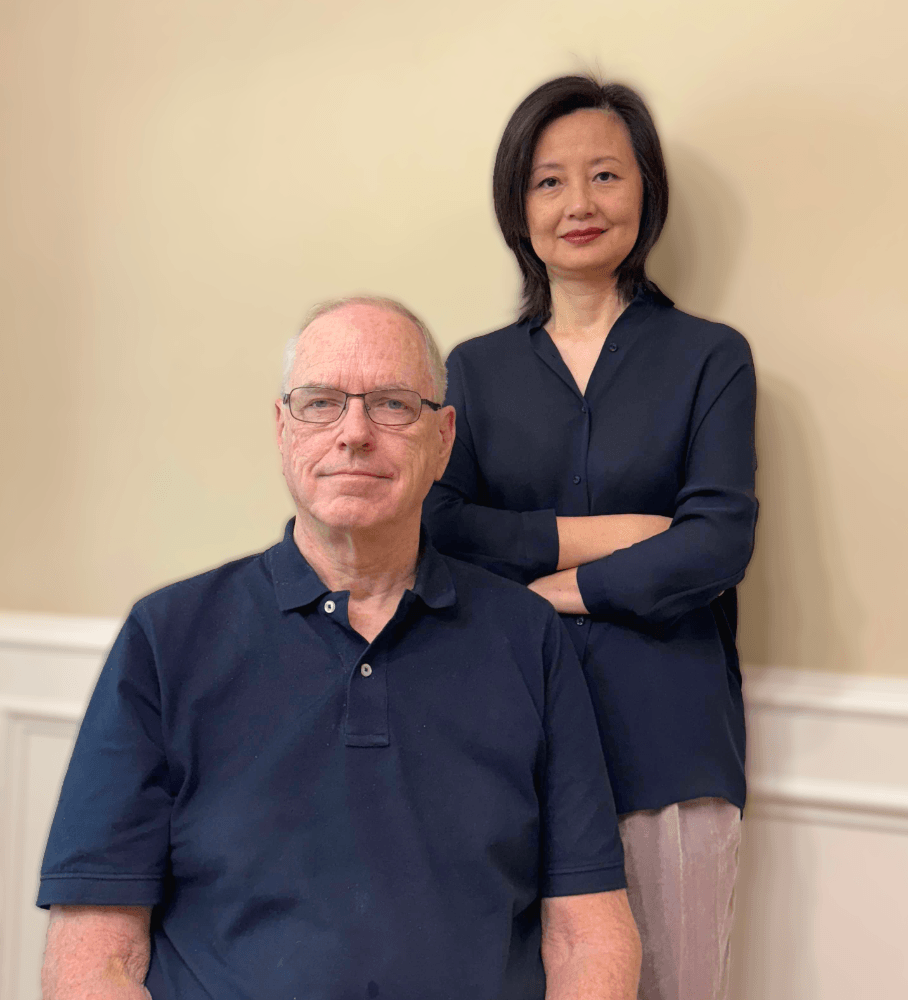

In an industry overrun with real estate “gurus,” quick-fix promises, “secrets”, and unreliable data, Fernwood is redefining what it means to invest with precision. Co-founded by Eric Fernwood and Cleo Li, the company is shifting the norms by bringing data-driven real estate investing, which was once reserved for institutional giants, into the hands of busy, high-earning individuals who want their investments to work smarter, with the least effort and time involved.

An Idea Born from Frustration

Eric Fernwood’s journey to creating his company didn’t start glamorously. In 2004, Eric was working in New York City. As a seasoned enterprise sales leader, he became increasingly frustrated by the traditional real estate process. After attempting to purchase income properties through “investor-friendly” realtors, he realized what was considered investment advice was just a stack of MLS listings.

He explains, “I started by reading all the popular real estate gurus. All I found was self-professed gurus offering opinions as facts with no basis in research or reality. I knew there had to be a better way.” He saw that what was missing was genuine analysis and tangible results. That realization sparked an idea.

Using his engineering background and experience in enterprise systems, Eric began to study how major retailers like Whole Foods and 7-Eleven made their location decisions. He found they didn’t choose locations based on cheap property prices but on customer behavior. He then realized that if real estate investors could think the same way by focusing on tenants over properties, they could find more success than what the gurus had to offer.

Creating a New Investment Model

It took years of research, trials, and setbacks, but Fernwood ultimately built a proprietary system that allows its team to evaluate tens of thousands of properties and select only those that align with its tenant-focused approach.

The results have been tremendous:

- Over 560 properties have been delivered to 170 clients around the world

- 90% of clients buy more than one property

- The average tenant stays for over five years

- Only seven evictions have occurred over 17 years

- Withstood both the 2008 housing crash and the COVID-19 pandemic with zero declines in rent or occupancy

- From 2013 to 2023, Fernwood clients enjoyed over 10% annual appreciation and 8% rent growth

- Maintained a vacancy rate under 2%

This is evidence of a reliable, repeatable system. They don’t just sell real estate; they engineer passive income streams for individuals. “We bring data-driven real estate investing to individual investors, helping them build passive income and grow their net worth while minimizing risk and maintaining a hands-off approach. We have a proven track record to demonstrate our ability to deliver,” the co-founder said.

Rethinking What Real Estate Can Be

Fernwood’s approach is tailored to professionals who value their time as much as their return on investment. Their ideal clients are high earners who want access to high-performance real estate investments without turning it into a second job.

Cleo Li’s mission is to help at least 1,000 investors build generational wealth by choosing intelligent properties. She envisions a future where high-performing real estate portfolios are no longer just for institutions but for individuals seeking financial freedom.

Fernwood offers a refreshing alternative to the instability of traditional real estate investing. Backed by 17 years of proven metrics, this duo doesn’t rely on short-term success; they rely on data and extensive experience. Fernwood invites investors to rethink what it means to invest smart.